illinois electric car tax credit income limit

Currently the federal government offers a 7500 tax credit when purchasing qualifying electric vehicles which could grow to 12500 if the federal government passes the 35 trillion social. This article previously stated the EV tax would be 248.

Rivian S Growth Changed This Midwestern Town S Fortunes Cnn Business

The Earned Income Tax Credit EITCEIC is a benefit for working people with low to moderate income that reduces the amount of tax owed and may result in a refund.

. Withholding credits earned on or after 1115. All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit. Illinois ridiculous 1000 EV tax is no more imposes 100 EV tax instead UPDATED Jameson Dow.

In addition buyers must apply for the credit within 90 days of purchasing the vehicle and rebates are restricted to buyers whose average income doesnt exceed 80 percent of the areas median income also taking household size into account. This could show up as part of your refund or as a reduction of the amount of taxes you would otherwise pay. Income Tax credit exempt from sunset.

Beginning on January 1 2021. Theres also an income limit for taxpayers to receive the credit. Senate approved a nonbinding resolution to set a 40000 limit on the price of electric cars eligible for the current tax credit.

35 ILCS 5236 REV Illinois Act Exempt from sunset No new DCEO agreements after 12312027 Income Tax. For individuals the maximum income would be 250000 and for single-income households the income limit would be 375000. The tax liability must meet or exceed the amount of credit youre requesting.

The proposed eligibility requirements for the EV tax credit are simple. To qualify you must meet certain requirements and file a tax return even if you do not owe any tax or are not required to file. The option to apply for an increased rebate is shown on the online application based on the income information the applicant provides.

28 would have provided a tax. But charging owners more to drive an electric vehicle in Illinois might slow down the momentum for EVs in the state. Illinois ranked seventh in EV sales last year at 6400 vehicles and with a total of about 15000 electric vehicles registered in the state.

Today the electric car tax credit provides a dollar-for-dollar reduction to your income tax bill. State and municipal tax breaks may also be available. Illinois wants to give you 4000 to buy an electric vehicle.

A clean energy bill that just passed in the state of Illinois has set a goal of adding 1. These limits are intended to direct the EV credit more toward middle. Unless its an electric motorcycle which doesnt qualify.

Cars need to be under 55000. 250000 for single people. For tax years that began on or after January 1 2018.

Also out are hybrids and cars that run on fuel cells natural gas carrot peels etc. How Much are Electric Vehicle Tax Credits. The version proposed earlier on Oct.

Electric Vehicles REV Illinois Credit. Illinois will give you 4000 for buying an electric car. The exceptions are Tesla and General Motors whose tax credits have been phased out.

There is a federal tax credit of up to 7500 available for most electric cars in 2021. You must have a federal tax liability in the year you purchase an electric car or plug-in hybrid to claim the tax credit. JB Pritzker signs Illinois new Clean Energy Bill into law.

To pay for rebates officials are relying on the Alternate Fuels Fund a 20 annual fee levied on vehicles owned by businesses with a fleet of 10 or more. If for example you owe 6000 in federal taxes you can only claim a credit of 6000 even if the vehicle qualifies for a full 7500 tax credit. Consumers with household incomes less than or equal to 400 percent of the federal poverty level are eligible for an increased rebate amount as listed below.

500000 for married couples or 250000 for single people. The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. However no new agreements allowed after 6302022.

3rd 2019 805 pm PT. This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours. An electric vehicle means an electric vehicle.

500000 for married couples. Non-cars vans trucks SUVs need to be under 80000 to be eligible for the credit. 2 That means that a 7500 tax credit would save you 7500 in taxes.

All electric and plug-in hybrid vehicles that were purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500 Here in Illinois Governor JB Pritzker as part of the recently passed Clean Energy Bill has promised rebates of 4000 to Illinois residents who buy themselves an electric vehicle. JB Pritzker signed Illinois clean energy law. In August 2021 the US.

Illinois Will Pay Residents 4K to Buy an Electric Car. Theres also an income limit for taxpayers to receive the credit. Coleman received a 7500 federal tax credit on his 40000 Chevy Bolt last year.

Illinois sweeping new clean energy law includes a 4000 rebate on an electric car up to 10 off on your electric bill and up to 9000 back on a solar roof. WIFR - As Gov. By Nara Schoenberg Chicago Tribune.

The amount of the credit will vary depending on the capacity of the battery used to power the car.

Illinois Will Pay Residents 4k To Buy An Electric Car Autoevolution

Rivian S Share Price Fell Further After Loses Widened And It Cut Back Its Production Forecast

Illinois Will Pay Residents 4k To Buy An Electric Car Autoevolution

Electric Vehicles Should Be A Win For American Workers Center For American Progress

The Story Of A Normal Car Factory Abandoned By Gas Guzzlers Soon To Be Buzzing With Electric Vehicles Nrdc

Electric Cars Rise To Record 54 Market Share In Norway Electric Hybrid And Low Emission Cars The Guardian

Illinois Will Pay Residents 4k To Buy An Electric Car Autoevolution

Illinois Will Pay Residents 4k To Buy An Electric Car Autoevolution

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

Rivian An Electric Vehicle Start Up Reveals Large Losses In Its I P O Filing The New York Times

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Illinois Will Pay Residents 4k To Buy An Electric Car Autoevolution

Pin On Elgin Vw Auto Loans And Financing

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/70504213/GettyImages_1367860597.0.jpg)

Bmw General Motors And Kia Are Running Super Bowl Ads Featuring Electric Cars Vox

How To Charge An Electric Car At Your Apartment Apartmentguide Com

Reimagining Electric Vehicles Rev Illinois Program Rev

Illinois Will Pay Residents 4k To Buy An Electric Car Autoevolution

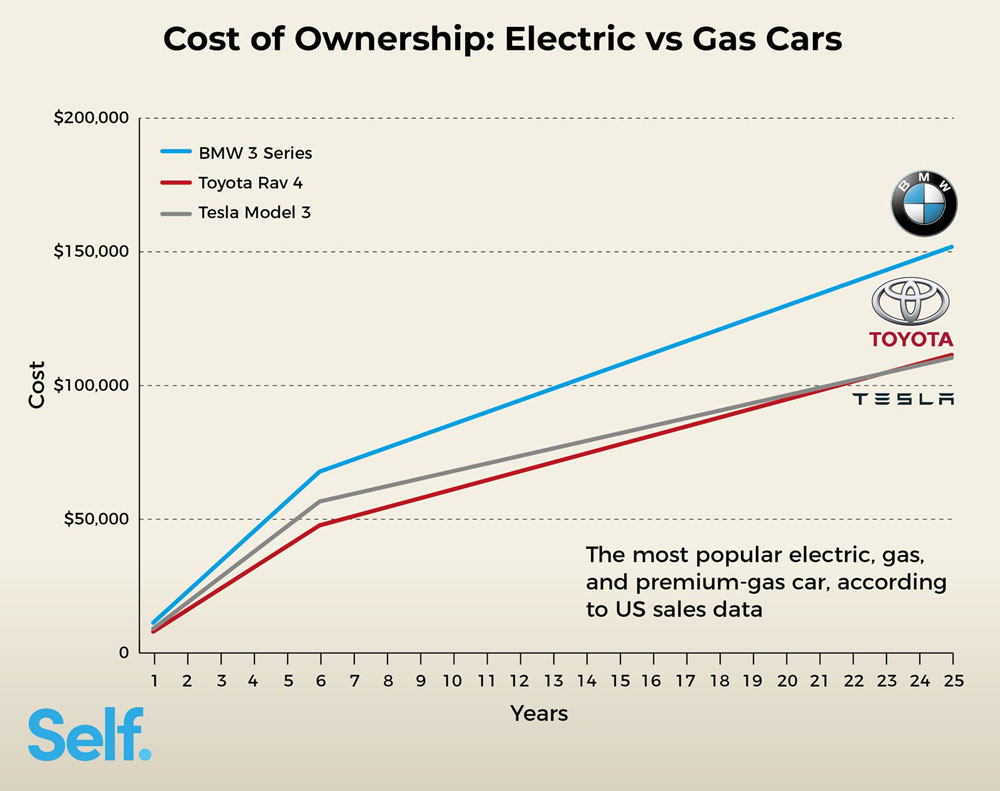

Electric Cars Vs Gas Cars Cost In Each State Self Financial

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist